Searching someone who can help with assignment help online? Hire our best assignment experts and enjoy the best grade.

aking control of your finances often gets pushed away from your mind while you focus on your assignments

rogramming assignments are the tasks and projects which are assigned to the students. These assignments focus on the

T

aking control of your finances often

and exams. But let's be honest: managing finance is a life skill you will benefit from if you master it. Financial management principles work in all situations, including saving pocket money, investing in mutual funds and managing a monthly budget.

gets pushed away from your mind while you focus on your assignments and exams. But let's be honest: managing finance is a life skill you will benefit from if you master it. Financial management principles work in all situations, including saving pocket money, investing in mutual funds and managing a monthly budget.

In this blog, you will get detailed insights presenting the essential financial management concepts every college student must understand to help them handle their finance assignments better. To understand these principles, you do not need a finance degree or have to be a finance student. An open mind and a few minutes of your time are enough to grasp these concepts!

Financial management is a creative practice and a logical process of handling money. It involves planning and organising to create practical approaches that control and monitor the utilisation of monetary resources to achieve individual goals or business objectives. Financial management is a strategy that helps you make effective money choices. Financial management principles include helping you determine between the EMI purchase of a new laptop and planning your college expenses.

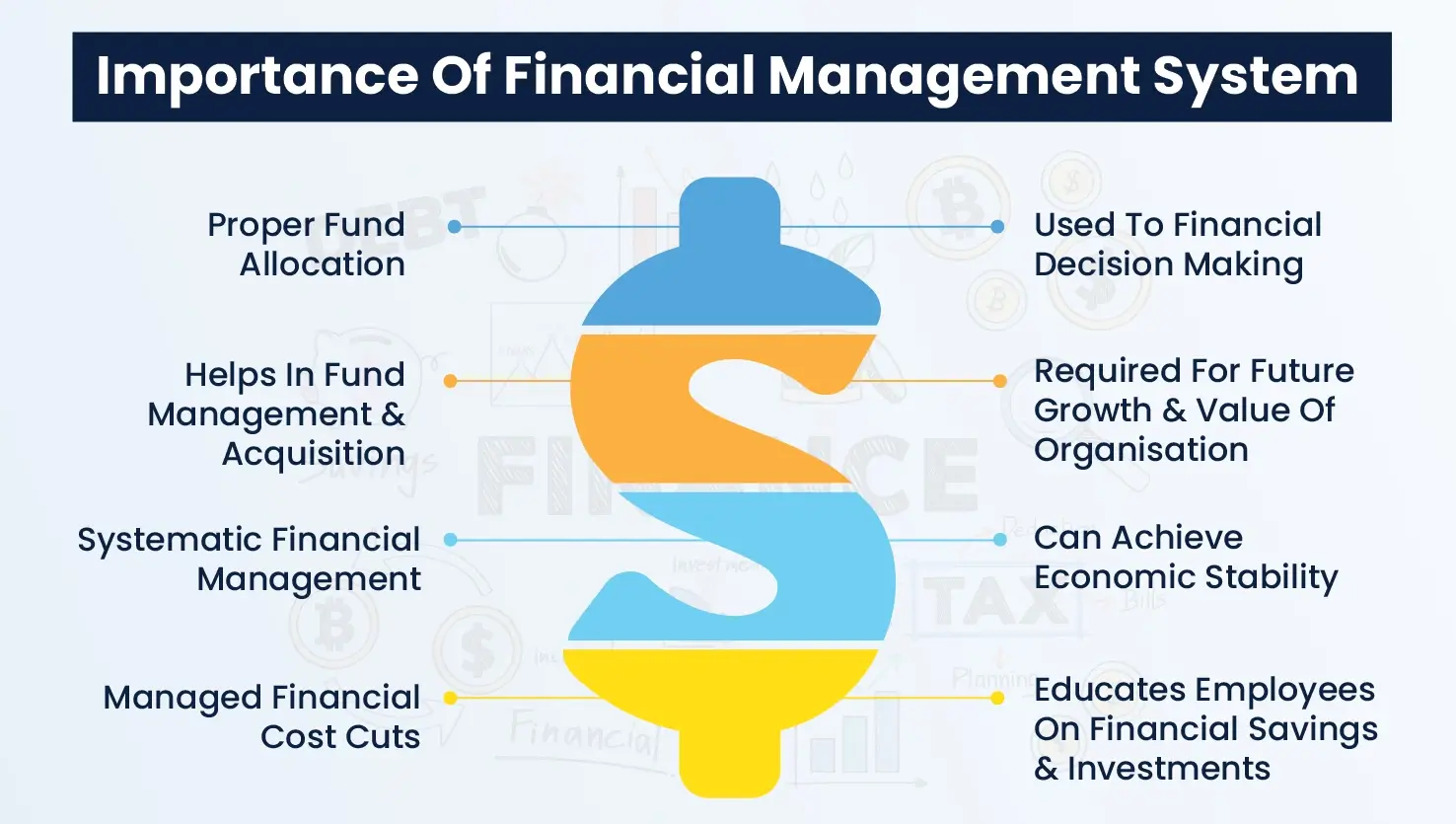

As students, you place your academic achievements, internship experiences, and career ambitions as your top priorities. Money management skills are underestimated by many, but they provide exceptional life advantages. Developing sound financial management knowledge also helps you work on your assignments effectively. Here's why:

You can manage your student loan better.

Avoid getting into unnecessary debts that can become a financial burden for you.

You learn essential financial responsibility, including saving money while investing and early wealth development through financial planning.

You learn to build the financial discipline necessary for becoming an adult.

You develop an understanding of how AI in finance industry is revolutionising it.

Understanding financial principles helps improve critical thinking skills that benefit your student years and future professionalism.

Let's discuss the six fundamental principles of financial management that can guide you in managing your daily expenses and enhance your understanding of financial management.

Risk and Return

According to this principle of financial management, every financial decision always involves risks. Generally, the higher the risk, the higher the expected return and vice versa.

Example:

Investing in cryptocurrency offers excellent returns, but it also involves the risk of losing the entire amount you have invested. While a savings account is a more stable option due to low risk, the return is also minimal.

Learning this principle not only helps you to tackle any complex assignment or course related to risk and return, but it also helps you to be financially successful as an investor. You learn to weigh the risk and return before investing, spending, or borrowing.

Time Value of Money

The time value of money (TVM) is a fundamental principle of financial management; it states that today's money has more value than money in the future. The value of money changes in future due to factors like inflation or changes in interest rates.

Example:

If you invest $1,000 in a savings scheme that offers compound interest, you will receive $1,200. However, if you wait and invest $1,000 after a year, you will lose the interest earned.

This concept teaches you that time is your biggest ally. As a student, you learn to save and invest from a very early age, even if it is small. It also helps you know about the various factors that affect the value of money.

Cash Flow Principles Of Finance

Cash flow refers to the movement of money in and out of your hands or bank account. The banking principle of finance requires monitoring financial resources to maintain adequate cash reserves that cover present and future obligations.

Example:

No matter how much you get from your scholarship or your part-time job. If you fail to manage your cash flow properly, you will face financial challenges, with hardly any money left to purchase your essentials or pay bills.

Cash flow is an essential aspect of students. As a finance student, you must understand the cash flow principle to analyse the regular spending of organisations and how it helps maintain monetary balance. It also allows you to track your spending. You learn to prioritise your needs over your wants, avoid overspending on luxury items and stay mindful of financial obligations.

Profitability and Liquidity Principles of Finance

This principle balances two essential elements: generating profits while maintaining sufficient liquidity. Profitability is about making gains, while liquidity is about having enough liquid funds for your financial requirements.

Example:

You have invested money in a long-term fixed deposit, but if you cannot pay for your hostel accommodation, you face a liquidity problem.

This principle teaches you the concepts of liquidity and profitability. It helps you understand that to be profitable, it is essential to have a liquid flow of funds to meet daily needs. You gain knowledge to manage your savings between long-term funds and have access to funds to meet your daily expenses.

Principle of Diversity

This is the smartest financial management principle of all. Using this principle, you can minimise the financial risk by spreading your investments across different assets and industries.

Takeaway:

Instead of spending your entire savings on some expensive gadget, you can diversify your spending by keeping money for emergency funds, saving, purchasing study resources, and spending on fun activities.

This principle helps you learn the basic concept of how investments can be balanced. Understanding diversity allows you to become a proficient finance person, and as you know, it is essential to diversify investments rather than relying on a single investment category. Mix it up to stay secure.

The Hedging Principle of Finance

Hedging means protecting yourself against unforeseen market losses. This financial discipline of hedging is used to set plans that reduce potential risks.

How to apply it:

You should always maintain a small emergency fund of $2,000 to $5,000 to cover unexpected health costs, technical breakdowns and travel challenges.

The hedging principle teaches students to always have a backup and be financially prepared to relieve stress.

Understanding the concepts of financial management can be daunting for you. Working on financial management assignments becomes even more challenging when the deadlines are approaching. Don't worry; Assignment World has got you covered. At Assignment World, we offer top-notch quality finance assignment help. Given below are some of the ways how we assist you in your assignment compilation:

Expert Writers: Our team contains expert writers from a finance background who hold PhD degrees and have subject-specific expertise.

Original Assignment: We have a zero-tolerance policy for plagiarism and

AI-generated content. Our writers draft your assignment from scratch and provide Turnitin reports to ensure authenticity.

Free Revisions: Our experts revise the assignments per your professors' feedback to match your requirements completely.

Custom Work: We tailor the assignments to your requirements at Assignment World.

Understanding the financial management principles discussed in this blog is an essential life skill. If you can adopt these principles early in life, you will develop better control of your finances and be confident in managing any financial crisis. Remember that you don't have to do it all at once. Start with making small changes. Manage your daily expenses, save small portions and avoid unnecessary expenses. By following this gradually, you will be able to master all six principles of financial management. And if you ever get stuck while working on your finance assignments, you can seek expert assistance from Assignment World.